EXCHANGE

Trading Related Information

Price Median Methodology

APEX adopts the 3-Price Median Methodology to determine the resulting price of a trade matched in its central order book.

1. What is the trade price algorithm that APEX adopts?

APEX adopts the “3-Price Median Methodology” to determine the resulting price of a trade matched in its central orderbook.

All buy and sell limit orders are ranked firstly by price (i.e. highest bid and lowest offer) and, secondly by the time the order is received in the central orderbook. The best bid and best offer price will be matched automatically if the bid price is greater than or equals the offer price.

The resulting price of the trade matched will be the median price of the three (3) prices, namely the bid price (VBid), offer price (VOffer) and the last traded price (VLast), to be precise:

- If VLast < = VOffer < = VBid, then the trade price is VOffer

- If VOffer < = VLast < = VBid, then the trade price is VLast

- If VOffer < = VBid < = VLast, then the trade price is VBid

2. Are there examples for this price methodology?

Please refer to Appendix.

3. How different is APEX’s “3-Price Median Methodology” from other commonly used price methodology?

The commonly used price methodology typically takes the price on the resting order of the opposite side as the resulting trade price (the “Resting Price Methodology”), whereas the 3-Price Median Methodology takes into consideration your matching order price, the last traded price, and the price of the resting order of the opposite side, when determining the resulting trade price.

The Resting Price Methodology gives a slight advantage only to the matching order as it has a chance of transacting at a better price (compared to the entered price on the matching order).

In comparison, the 3-Price Median Methodology may give both resting and matching orders a chance of transacting at a better price as a median price is used. Below are some examples to further illustrate this point:

Example 1:

| Last Traded Price | Bid of a Matching Order | Offer of a Resting Order | APEX Traded Price | Traded Price by Resting Price Methodology |

|---|---|---|---|---|

| 102 | 101.5 | 101 | 101.5 | 101 |

If a trader enters a bid of 101.5 for a limit order, under APEX’s price methodology, the traded price will be 101.5, which is the median price out of 101, 101.5 and 102. Conversely, under the Resting Price Methodology, the traded price will be 101, which is the price of the resting offer in the orderbook.

In this scenario, whilst the Resting Price Methodology benefits the matching (buy) order more since the traded price is lower, the 3-Price Median Methodology resulted in the resting (sell) order transacting at a better price of 101.5 than its entered price of 101.

Example 2:

| Last Price | Bid of a Resting Order | Offer of a Matching Order |

APEX Traded Price |

Traded Price by Resting Price Methodology |

|---|---|---|---|---|

| 102 | 103 | 101 | 102 | 103 |

If a trader enters an offer of 101 for a limit order, under APEX’s price methodology, the traded price will be 102, which is the median price out of 101, 102 and 103. Conversely, under the Resting Price Methodology, the traded price will be 103, which is the price of the resting bid in the orderbook.

In this scenario, whilst the Resting Price Methodology benefits the matching (sell) order more since the traded price is higher, the 3-Price Median Methodology still allows both buyer and seller to transact at a better price (than the respective entered prices).

Example 3:

| Last Price | Bid of a Resting Order | Offer of a Matching Order |

APEX Traded Price |

Traded Price by Resting Price Methodology |

|---|---|---|---|---|

| 104 | 103 | 101 | 103 | 103 |

If a trader enters an offer of 101 for a limit order, under both APEX’s price methodology and Resting Price Methodology, the traded price will be 103, which is the median price out of 101, 103 and 104, and also the price of the resting bid in the orderbook.

In this scenario, both methodologies produce the same effect which benefit the matching (sell) order more since the traded price is higher (than its entered prices).

4. Would it affect the way I trade?

If you have the intention to hit the bid or lift the offer, you will need to take note of your own quotation, as the resulting traded price will be the median price of the last traded price, price of the resting order and your quotation.

However, the resulting traded price will never be worse than your quotation.

5. How does APEX’s price methodology affect the traded prices in Continuous Trading?

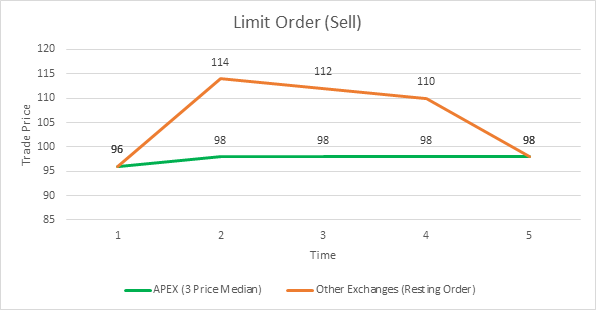

In some circumstances (as shown below), the 3-Price Median Methodology helps to smoothen the fluctuations of traded prices. Below are some examples further illustrating this point:

Example 1:

| Time | Last Price | Bid of Resting Orders | Offer of Matching Orders | APEX Traded Price | Traded Price by Resting Price Methodology |

|---|---|---|---|---|---|

| 1 | 96 | 96 | 96 | ||

| 2 | 96 | 114 | 98 | 98 | 114 |

| 3 | 98 | 112 | 98 | 98 | 112 |

| 4 | 98 | 110 | 98 | 98 | 110 |

| 5 | 98 | 98 | 98 | 98 | 98 |

This example illustrates how the price methodology affects the price movement when sell limit orders come in.

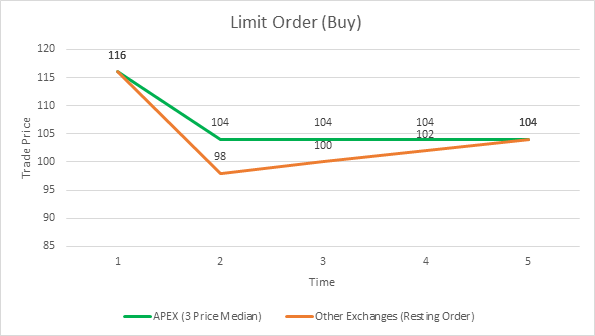

Example 2:

| Time | Last Price | Bid of Matching Orders | Offer of Resting Orders | APEX Traded Price | Traded Price by Resting Price Methodology |

|---|---|---|---|---|---|

| 1 | 116 | 116 | 116 | ||

| 2 | 116 | 104 | 98 | 104 | 98 |

| 3 | 104 | 104 | 100 | 104 | 100 |

| 4 | 104 | 104 | 102 | 104 | 102 |

| 5 | 104 | 104 | 104 | 104 | 104 |

This example illustrates how the price methodology affects the price movement when buy limit orders come in.

6. How will APEX’s price methodology affect market orders?

The 3-Price Median Methodology will not be applied to market orders. The resulting traded price(s) for a market order will always be the price(s) of the resting limit order(s) in opposite side. Market orders cannot be matched with other market orders.