by APEX News | 2019-11-06

2019年11月6日,新加坡亚太交易所(简称:APEX)与金联创网络科技有限公司(简称:金联创)签署合作备忘录。备忘录由新加坡亚太交易所首席执行官朱玉辰先生和金联创董事长黄海新先生共同签署。

APEX首席执行官朱玉辰先生表示,APEX是经新加坡金融管理局批准设立的第三家全牌照交易所,自开市交易以来,已经成功推出了五个期货合约,范围涵盖能源、农产品和金融领域,吸引了众多投资者和产业客户在APEX进行资产配置和套期保值,具有良好的客户基础。本次与金联创的合作,对双方都是良好的契机,一定会助力双方为市场提供更好的服务。

金联创董事长黄海新先生说,金联创一直秉承“让大宗商品交易更高效”的企业使命, 通过十六年行业积累,金联创已经形成了庞大专业的行业数据库,能有效帮助客户把握商机,实现安全、高效交易。相信本次与APEX的合作,双方都将大有可为。

根据合作备忘录内容,双方将在估价(基准价)应用、信息数据交换、经纪业务、产品设计、市场推广等方面开展合作。

by APEX News | 2019-11-05

新加坡亚太交易所与中国期货行业协会签署合作备忘录

11月5日,新加坡亚太交易所(简称:APEX)和中国期货业协会(简称:中期协)在北京签署了合作谅解备忘录,建立了合作关系,双方将在共同关心的领域进行深度合作。

中期协王明伟会长说:“中期协与APEX具有良好的合作基础。推动国际交流与合作是协会重要职责之一,多年来中期协一直致力于推动中国期货业与境外机构的交流与合作。新加坡亚太交易所作为中国人首次出海创办的国际化交易所,能够在亚洲金融中心新加坡落地开花,具有重要的意义和广泛的国际影响力。我们很高兴与新加坡亚太交易所签署这份合作备忘录,这是双方建立伙伴关系的重要标志。我们期待双方能够共同努力,积极推动期货衍生品行业的发展。”

新加坡亚太交易所CEO朱玉辰表示,APEX对与中期协的合作期待已久、高度重视。APEX是经新加坡金融管理局批准的具有交易和清算全牌照的交易所,一直努力争当中国期货市场国际化的试验田。自去年5月25号正式开市交易以来,目前已经上市了包括棕榈油、燃料油在内的五个产品,吸引了众多投资者和产业客户在APEX进行资产配置、宏观对冲、跨市场与跨品种套利。中期协作为中国期货行业的自律组织,在服务会员、自律管理、反应行业诉求、维护期货市场稳定发展方面,发挥了重要的作用。希望借本次合作的东风,加强双方的信息互通,在共同关心的领域不断深入合作。

根据备忘录协议,双方管理层将定期进行沟通会面,双方员工将通过互换、培训等多种方式,加深对中国和新加坡市场的了解,并对共同关心的课题展开研究。

关于中国期货业协会

中国期货业协会是根据《社会团体登记管理条例》设立的全国期货行业自律性组织,接受中国证监会和国家社会团体登记管理机关的业务指导和管理。 协会由以期货经纪机构为主的团体会员、期货交易所特别会员组成。

by APEX News | 2019-10-21

Source: ARGUS MEDIA

The Asia-Pacific Exchange (Apex) Argus Bunker Index (ABI) futures contract attracted 120 trades on its first day of activity in Singapore today.

The ABI Singapore LSFO 0.5%S futures is a cash-settled derivatives contract for low-sulphur fuel oil (LSFO). Traded volumes totalled 1,200t by 6pm today.

The December, January and February contracts’ last traded prices were $539.10/t, $543.50/t and $537.40/t, respectively. The market settled at a $4.40/t contango between December and January, and a $6.10/t backwardation between January and February.

“The latter makes sense, particularly for LSFO, as more product becomes available, so the market will expect prices to be lower further out in line with crude,” a trader said.

A total of 12 consecutive monthly contracts are listed on Apex. The final settlement price is the average of Argus’ LSFO 0.5%S bunker assessments during the contract month.

ABI Singapore assessments were launched in June 2018 and are calculated using fixed-price delivered-to-ship bunker transactions between suppliers and shipowners reported to Argus by 7pm each Singapore working day. More than 40 companies contribute trade data.

The LSFO 0.5%S index represents the price of bunker fuel delivered between four and 12 days from the trade date, for volumes between 500t and 3,000t with viscosity of less than 380cst and sulphur content of below 0.5pc. Argus removes price outliers using a statistical analysis prior to calculating a volume-weighted average, representing the average price shipowners paid for fuel of that specification on that day.

Argus has reported a total of 43 LSFO deals so far in October, as well as 185 high-sulphur fuel oil and 123 low-sulphur marine gasoil deals.

To see original article:

https://view.argusmedia.com/APAC-ONL-2019-Argus-Oil-LinkedIn-Oil-Products-KK_26-211019-Oil-Products-LP-1.html?utm_source=linkedin&utm_medium=social&utm_content=news-landing&utm_term=pro&utm_campaign=APAC_Weekly_Stories

by APEX News | 2019-10-21

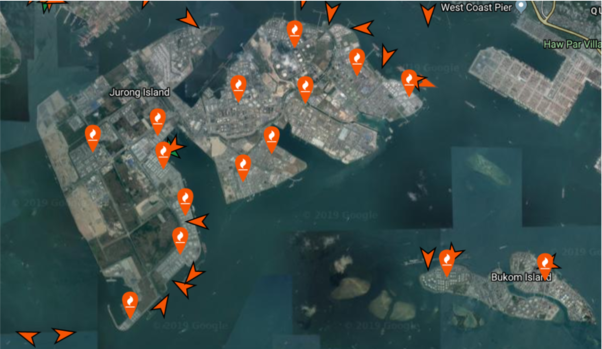

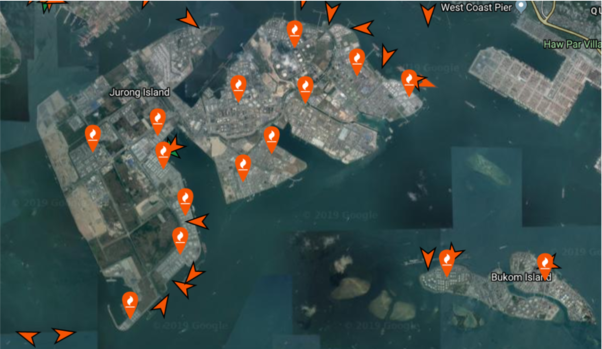

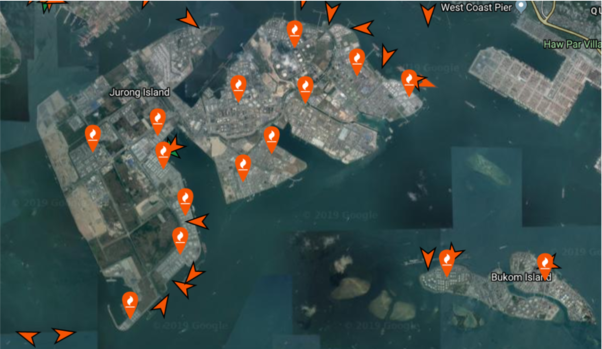

Asia Pacific Exchange has adopted Kpler to track real time seaborne flows to facilitate the process for the recently launched physically delivered products i.e Crude Oil and Fuel Oil. Kpler’s strength is in collating data and running it through advanced algorithms based on pattern analysis, machine learning and linear programming. This allows the Exchange to have a better appreciation and anticipation of the physical delivery process,a better facilitate communication with both Buyers and Sellers trading on the platform to minimise any disruption with the empowered predictive analysis.

About Kpler

Kpler is a data intelligence company providing real-time transparency solutions in commodity markets. Since 2014, Kpler has pioneered the utilization of big data to the benefit of commodity market professionals including world-leading trading houses, industrial and shipping companies, as well as financial players. By providing full transparency around commodity movements, Kpler enables unique insights that help to drive new opportunities and improve business decision making. Kpler has offices in Houston, New York, London, Paris, Dubai and Singapore. https://www.kpler.com/

by APEX News | 2019-10-18

Asia Pacific Exchange (APEX) and Zhejiang Mercantile Exchange (ZME) signed a Memorandum of Understanding on the cooperation in the oil business during the third International Petroleum and Natural Gas Enterprises Conference (IPEC) in Zhoushan, China.

Alongside APEX, there were many internationally renowned companies involved in the signing of the MOU, including BP, Exxon Mobil, Honeywell, Total, Sinopec, PetroChina and Sinopec Zhonghai.