USD/CNH FUTURES CONTRACT INTRODUCTION

1. Why did APEX launch the USD-CNH Futures Contract?

With the acceleration of the internationalization of the Renminbi (RMB), the international status of the RMB has been on the rise. The RMB is widely used in global trade and investment, and increasingly becoming one of the important international reserve currencies. The pace of reform of the RMB exchange rate regime is gaining momentum at the same time with greater international trade flows, resulting in trends of higher volatility and increased fluctuation in both directions of the exchange rate.

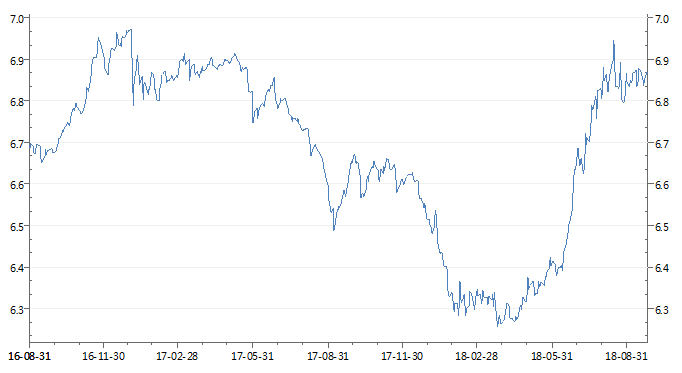

Source: Wind Financial

Note: USD/CNH exchange rate for the past two years

2. Why trade APEX UC Contract?

a) Weekly contract formation: flexible for different investment and hedging time horizon

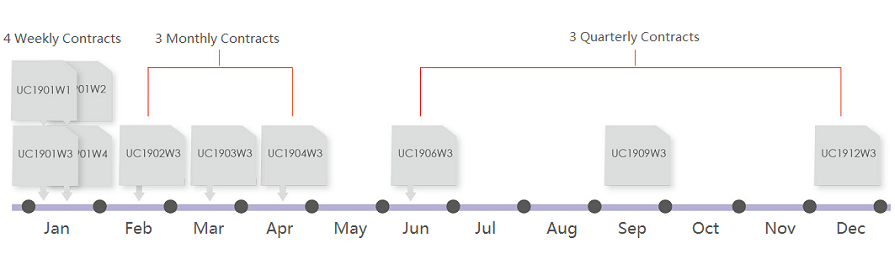

As the world’s first weekly USD/CNH contract, the UC Contract will list “four nearest weekly contracts + next three monthly contracts + next three quarterly contracts”, on a rolling basis, meeting the needs of clients with different investment and hedging time horizons.

Example based on 2019 Contract series

b) Smaller Contract Size: customizable for different investment and hedging exposure

The UC Contract will be sized at US$10,000 per lot. The small contract size is expected to be more liquid than larger sized contracts and will be more customizable to fulfill the needs of clients’ with different hedging and investment requirements.

c) Cash Settlement: convenient and economical

The contract’s final settlement price is based on the USD/CNH spot rate published by the Treasury Markets Association (TMA) on the last trading day (LTD). Cash settlement has the benefit of requiring low cash outlay at the expiry of the contract. Clients only need to settle the profit and loss, which is economical on capital and convenient.

Why is the Final Settlement Price based on TMA USD/CNH spot rate?

Treasury Markets Association (TMA)’s USD/CNH (Hong Kong) spot exchange rate is the authoritative benchmark for the offshore RMB spot rate and is the widely accepted benchmark for settlement by many major global exchanges.

3. How to access APEX market information and data?

Access APEX market data through the following software vendors:

Esunny, Thomson Reuters, Bloomberg, WIND Financial Terminal, Webstock myTrader and Pobo5. For more information on how to access the market data, please visit APEX Investor Guide.

4. How to trade the APEX UC Contract?

Trade APEX products including UC and Palm Olein contracts through our 6 clearing members: Phillip Futures, KGI Securities (Singapore), HGNH International Financial (Singapore), DA Financial Service (s), Straits Financial Services, UOB Kay Hian Private Limited. For more information, please check our list of Clearing Members.

Disclaimer

Futures trading may have complex features and risks which can expose an investor to various factors, including the incurring of losses. Hence, futures trading may not be suitable for everyone. Futures are leveraged investments and, it is possible to lose more than the amount of money deposited for a futures position. Please consider carefully whether futures are an appropriate instrument for you. Investors should ensure that they fully understand the risks involved, or contact their broker to obtain further clarification.